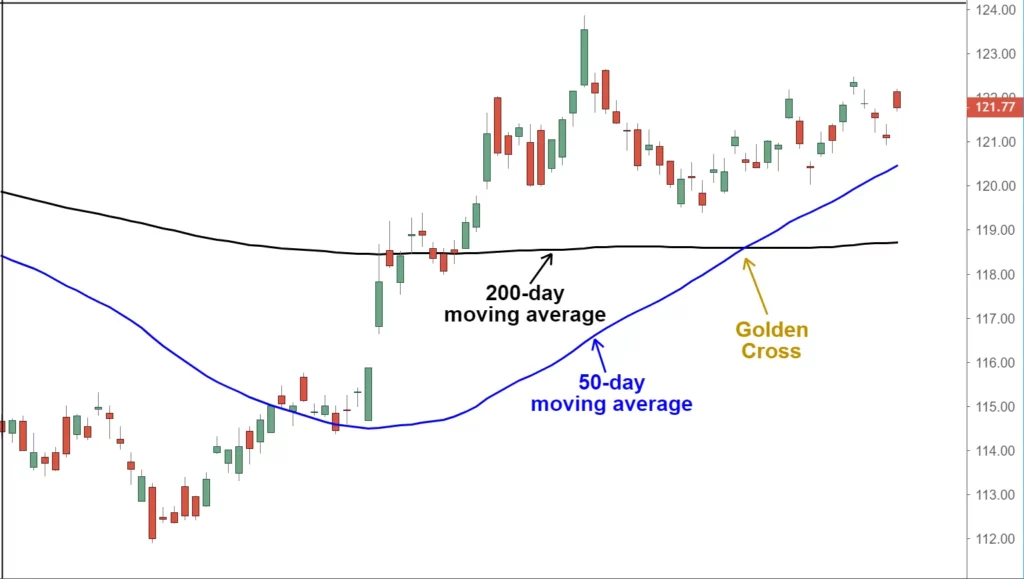

Bullish signals are formed when a very short-term moving average crosses over a longer-term moving average in a chart pattern known as the golden cross. The golden cross stock is a bullish breakout pattern that involves a security’s moving average, such as the 15-day average, breaking above its long-term moving average (such as the 50-day average) or resistance.

What can a golden cross stock reveal about you?

According to Google, there are three phases to a golden cross. A decline will finally finish if selling has halted in the first stage. When the shorter moving average crosses the larger one in the second step, the trend reversal is confirmed.

The third phase is to keep the rising trend going in expectation of higher prices.

During pullbacks, the moving averages are employed as support levels until they cross back down. A death cross could appear at that point.

Death cross

In comparison to the gold cross, the death cross is the polar opposite. The death cross occurs when the shorter moving average crosses over the longer moving average. The most frequent moving averages are 50 and 200-period moving averages. A period is a unit of time. Stronger and longer-lasting outbreaks are more likely to occur over longer time periods.

The most bullish signs for an index such as the S&P 500 are the daily 50-day moving mean crossing over the 200-day moving median.

The proverb, “A rising tide lifts all ships” is true when a golden cross appears in the buying echoes across the index components and sector. Day traders often trade intraday golden cross breakouts using smaller time periods such as the 5-period or 15-period moving Averages.

You can change the chart’s time interval from one minute to weeks or even months. Time periods on charts can also be changed to provide more signals. When the chart time period increases, the golden cross breakout tends to be stronger and lasts longer.

Is golden cross in stock?

Golden Cross stock plays a major role in Stock Market analysis. It can tell the marketer what the averages are in the trade.

To understand how the cross is produced, you must first comprehend the notion of moving averages. A technical indicator is a moving average. It’s made by multiplying the worth of several assets.

There are many types of moving averages: simple MA, exponential MA, and weighted MA. All of these moving averages are based on the same principle, but use different formulae to minimize or eliminate the lag in simple moving averages.

For example, the exponential MA reduces lag because it gives current prices more weight. However, the WMA reduces the lag by diluting early data.

When an asset’s value is falling for a prolonged time, the golden cross happens. The price rises to the longer-term average after it has risen to the short-term average.

How do you find the golden cross?

According to Google analysts and traders view it as a major upward movement in the market when a short-term average crosses over a significantly longer-term average to the upside.

Some analysts define it as crossing the 100-day average by the 50-day average. Others describe it as crossing the 200-day average by the 50-day average.

The golden cross stock is a technical chart pattern that indicates the possibility of a significant rise. When a stock’s short-term moving average crosses over its long-term moving average, a golden cross show on the chart. A golden cross contrast with a death cross, which indicates a negative market trend.

What does the golden cross stock signify?

The concept of the golden cross is very simple. The 50-day moving average is the first indicator that an asset’s price has begun to rise. Others are left on the sidelines as buyers begin to push the price up.

The price will continue to rise if it exceeds the 200-day moving average. Many traders and professionals view the Golden Cross as an essential technical indicator.

In a given market, the chart pattern is predicted to attract a large number of purchasers. It could become a self-fulfilling prophecy if that happens. Traders notice the pattern and decide to buy the market. This can be enough to establish or sustain a bullish trend.

Why have a golden cross in stock?

As Wikipedia states This trading strategy is superior to buy and keep investment when compared with the signal backtest. The Golden Cross is a simple way to avoid drawdowns in weak markets and can offer higher returns than buy-and-hold investment.

If you are re-entering a market position after a bull market has begun, it is a good idea to exit early during a downturn in order to build up a better cost base.

This approach is more like trend-following or investing in terms of time span than swing trading or day trading.

Cash signals can aid in the reduction of capital loss. This moving average approach is long during bull markets. However, it does not work well in prolonged downtrends.

It filters out most of the noise from price movements, so it doesn’t generate as many false signals when prices are volatile. It is slow to respond to market crashes and can be slow in general.

The golden cross pattern has a high-profit potential.

Unlike other technical patterns, the golden cross pattern’s profit potential is not usually stated explicitly. The objective behind utilizing a golden cross as an indicator is to identify a shift in price trajectory into an uptrend and then trade that trend. This rally might endure for a short time or for a long time. Other indicators that the trend is coming to an end, such as when the short-term DMA goes back below the long-term DMA, might aid in determining whether to take profit.

Are you ready to transform your trading business with the right tips and tools?

Stock trading can be difficult and has its ups and downs. Sometimes you can do well and other times you might need someone to look after you like an angel.

We can help you solve your problems and provide a tool that will allow you to review your stock trading. You might have heard of 1000pip Builder If you are looking to make money or interested in Forex trading, you might be concerned about whether you can trust the internet due to so many scams.

1000pipbuilder’s services are very simple. They will give you all the information you need and make recommendations to help with your trades. Then, they will send you emails with instructions about how to follow their signals.

Their services are available to clients at all times during the trade days. Anyone, anywhere on the earth, can promote this service.

Here are some services they offer:

- Signals are available 24 hours a day.

- All services are available during business hours.

- Tutorial on how to track and use trading signals

- Any type of assistance that you need with your transactions may be provided.

- How to Choose a Trading Broker

- Each day, there will be between two and seven signals.

- A monthly rate of 350 pip is expected.

- You can cancel your service at any time

Benefits of 1000pip builder

Each of the five business days is available for service.

The 1000pip Builder service is available seven days a week. This means that you will have lots of support throughout the trade days.

Forex trading with a professional:

Join 1000pip Builder to get the chance to learn from Forex trader’s pros. If you’re new to Forex trading, this is the best way to learn.

The 1000pip builder is suitable for beginners.

1000pip Builder was created for Forex traders who are new to the industry. 1000pip Builder can be a great alternative if you’re new to Forex trading and want to make some money.

If you have any questions about a trade, you can send an email.

If you have any questions, send an email to 1000pip Builder support. They will get back to your shortly.

The investing strategy yielded outstanding returns when tested.

Using the 1000pip builder investing strategy, some customers have had great success. It may be different for each customer, but it shows that you have a high probability of success with their service.

For whom is 1000pip builder intended?

1000pip Builder is not like other Forex signal providers. Despite the fact that most of its clients are novice currency traders or have previously failed, it does not limit its clientele.

An expert’s perspective can be helpful to those who are new or experienced traders. 1000pip Builder is not as appealing to them.

What sets 1000pip builder apart from the rest?

Although the 1000pip Builder might not be the most popular, there are many 5-star reviews on Trustpilot as well as ForexPeaceArmy that indicate it is a good choice.

A mentor also manages the signals service. One of 1000pip Builder’s most attractive features is Bob James’ decade-long knowledge of several Forex markets.

The site also promotes a training community and additional support for those who enroll.

The 100pip Builder is a forex trading tool for novices.

Forex beginners face one of the greatest challenges: they don’t have a good grasp of all the moving parts and factors.

1000pip builder being the best strategist

This tool’s trading strategy seeks to provide significant and consistent earnings with a low risk of losing money. We employ a variety of trading strategies, each of which is adapted to certain market situations. Over the course of the 24-month test period, our trading techniques generated an astonishing 6,500 pips. Professional Forex traders are masters of risk management, and we ensure that each deal is meticulously monitored. To maximize our profits, we always employ tight stop losses and closely monitor our holdings.

Why is 1000pip builder a must-have to obtain the golden cross?

Utilizing the golden cross with additional indicators and filters is key to success. It’s important to use appropriate risk criteria and ratios. It is possible to achieve better results by following the cross’s timing and ensuring a positive risk-to-reward ratio. You will need 1000pip Builder.

It is easy to see why currency traders and hedge fund managers favor the golden cross.

The technology formation is easy to use and reliable when used correctly. Using a basic technical tool that is included in practically all charting software, you may earn extra money in a 24-hour trading market.

The final word

You don’t need to worry about getting a golden cross because 1000pip builders will make sure that you do!

As your guardian angel, 1000 Pip Builder will ensure this, the golden cross exception is easy to attain. This tool is essential for any stock trader, whether you’re an amateur or a professional.

1000pip Builders’ outstanding services will not let you fall behind in the trading business. They will make you stand out from all others.

Best Trade Master Strategist

Let’s pretend to be a trade master while sipping coffee on a comfy couch. You only need the right tool to complete the task. Marketers need to be able to understand the technical details of when they can make a profit or lose money. The Stock Market is an ever-growing business.

Many tools have been added to the market to satisfy the needs of stock marketers. This 1000pip builder, a reliable and customer-friendly source, can help you earn more than you ever imagined.

If you are just starting out in stock trading and wish to make a fortune quickly, then don’t worry!

Success is at your doorstep!

Utilizing the golden cross with additional indicators and filters is key to success. It’s important to use appropriate risk criteria and ratios to ensure that you are using the right tools. It is possible to achieve greater results by following the cross carefully and maintaining a positive risk/reward ratio.

It is easy to see why currency traders and hedge fund managers favor the golden cross. In a 24-hour trading market, you can supplement your revenue by employing a basic technical tool found in almost all charting software.

Do you want a golden cross? The answer is right in front of you!

Pingback: Golden Cross Stock Trading