You can use positive pay to reduce cheque fraud. A positive pay system is a beneficial anti-fraud system that works very well for cheques. A positive pay cheque is pretty much bulletproof. When you try to cash in the cheque, the bank will match the details on it with the details sent by the issuer company. If they don’t match, then the cheque is not legit.

The system really helps protect against losses and different kinds of liabilities. The banks offer the service. Companies will usually have to pay a fee for it, but some banks offer it for free as well. For example, for positive pay, the city bank is the automated check machine for City Bank. So, you can use positive pay to reduce fraud with City Bank? Pretty much the same:

- cheque fraud

- locates the exception cheques in real-time

- reviews of the exception items online

Positive pay to reduce which fraud?

Positive pay for banks, like City Bank, can be a system that provides other service features as well. It depends on the bank. So, if you use positive pay with the bank City Bank, you will also get:

- Cheque inputs into your online banking system either in batches or individually

- Cheque monitoring every day

- Furthermore, the bank will automatically release the cheques that match the information given by your company

- The client receives instant notifications if a cheque is suspect

- These exception items are sent back to the client, and the client can choose to pay or return them

- The service also provides support for local businesses

The Bank of America positive pay is also a popular service. What sets them apart from the rest is the complex exception types classification that they make. You can set these exceptions as:

- the cheques that are not on the issue file

- cheque paid with duplicate serial numbers

- other cheques that have a different amount than what is mentioned in the issue file

- you can also set exceptions for cheques with zero serial number

- canceled cheques

- the ones that exceed the maximum amount

- Other Payee Positive exceptions are available for customization

Positive pay with oracle banking payments release

Now that we’ve tackled every positive pay definition in the book, looked at the benefits and how to generally use it, let’s get a bit more in detail on how this anti-fraud system really works.

Let’s take the case study of the Oracle Banking Platform. It is a comprehensive solution that helps banks manage complex transactions and make technology more friendly. For small to medium companies, there are much less expensive solutions, like digital payment services. But we’ll get to that. For now, let’s get back to the Oracle Banking Platform and how to integrate the positive software into it.

The Platform allows for a positive pay agreement scan which is the check that banks make when a new cheque cash-in is requested. Everything is automated and controlled by the system, in our case, the Oracle Banking Platform. Here, you can search positive pay for records using two parameters: the authorization status and the record status. Once you click “search”, the system will display the info you need.

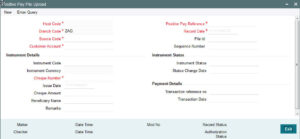

To upload a positive pay file, a bank using the Oracle system will need to go to “Positive Pay File Upload”. Here there are a couple of fields to fill in, including host code, record date, customer account, currency, etc.

This is pretty much how it looks from the bank side. It is important to know a positive pay file gets into the system and how it’s verified, usually in real-time.

Payee verification for positive pay to reduce fraud

The positive system is related to several banks and a plethora of verifications. In the case of positive pay with payee verification, you should know that the bank checks one more information. In addition to the check, serial number, and the amount on the cheque, the name of the Payee will also be verified. The issuer will include this name in the positive pay file. The company must take full responsibility for the information provided.

The exception cheques that we mentioned above are the ones that do not match the info provided in the Cheque Issue File. They are subject to further verification by the company. The bank will let the company know there is something suspicious with those cheques.

However, didn’t you have enough of these cheques and payees and verifications of any kind? How about a digital payment system that is safe and easier to use? Yes, cheques are still important, and some companies are still using them. Nevertheless, they’re very prone to fraud. Let’s look at something more modern and better for the online marketing businesses of today.

Payoneer: 2021 features, fees, and capabilities

Payoneer is a great service provider for online payments. You don’t need to maintain a merchant account to send and receive payments. This puts Payoneer on the same par with PayPal, Stripe, or Square. These platforms are quite popular with freelancers worldwide. Small to medium businesses also love these payment solutions.

Before we jump to what Payoneer can do, let’s discuss what it cannot do. First and foremost, Payoneer is not a merchant account provider. This means that you cannot integrate it as a point-of-sale for your business. It does not accept payments by credit card.

However, Payoneer can do a bunch of things that are both useful and cool for your business. With Payoneer, you can send and receive payments worldwide and are not limited by currency. It supports over 150 different currencies. That’s wonderful. What is even more wonderful is that you can make all these transactions via bank transfer. This will minimize the cross-border fees by up to 71%. Payoneer localizes bank transfers in the USA, the UK, Japan, Canada, Australia, and Mexico.

So, you can use Payoneer easily for B2B transactions. Moreover, if you operate on one of the big e-commerce marketplaces, then Payoneer is the solution. It doesn’t charge a fee for every bank transfer. Some are free. Just check their terms and conditions.

You can create an account on Payoneer in a few minutes directly from their website. It is free to open an account, no worries.

Main features

Have you opened an account? Perfect. Now, let’s walk you through the main features and capabilities of Payoneer.

First and foremost, there is the “send and receive payments” solution. You can make transfers worldwide without sweat. Payoneer uses Global Payments to receive local bank transfers from companies in the EU and other 6 countries, including the USA, the UK, Japan, Canada, Mexico, and Australia. If you’re in these countries, it means you can receive Payoneer transfers directly into your local bank accounts, but without the fees that would normally follow.

Payoneer is very helpful with ACH transfers. ACH transfers usually take one business day. The banks and financial services process these transfers in batches. They’re not individually handled, and that makes them free or very low cost.

By comparison, wire transfers happen on the same day. The money moves from one bank to another quickly. The process is usually automated, but sometimes it might get delayed if it’s been selected for additional checking.

Usually, banks charge between $10 and $35 for a wire transfer in the United States. International costs can even go higher. This is why ACH transfers are preferable. They’re low cost, almost free, and you can make as many as you want. Use positive pay to reduce which fraud? No fraud here. Moving right along…

Freelancer case study

Now, let’s take a real-life case study. You are a freelance content writer working with various clients from all over the world. You finish one job, and you want to get paid. So, you send your customer a transfer request with the exact amount of money you had previously agreed upon. The client will receive this request via e-mail, and he’ll have to choose from a couple of payment methods. Once the customer pays, your money will arrive in your Payoneer account.

At this point, you can easily transfer the money to your personal bank account and in your local currency. It is worth mentioning again that it provides over 150 different types of currencies. So, that’s quite impressive. These funds are usually available almost immediately. You can easily withdraw money from an ATM.

What is more, you can use Payoneer on quite a lot of important marketplaces, such as Fiverr, Upwork, or Airbnb.

Payoneer for developers

Payoneer does have an API that facilitates recurring payments. You can debit a specific Payoneer balance for that. Payoneer will only debit the account if there is enough money. It won’t charge back.

As for mobile apps, Payoneer also offers a mobile app. It is available both on iOS and Android. Users can install the app to check their account balance at any time. The app also displays basic information such as transactions or enables you to withdraw funds. Nevertheless, you cannot make payments from the mobile app. We hope they solve this issue. It’s quite a party pooper, so to speak.

Security

Payoneer is AML/CTF compliant. It has multiple layers of risk technology. At least that’s their statement. They’re also PCI Level 1 Certified with regular audits.

Payoneer is audited regularly concerning their KYC requirements. KYC is the process of ID cards, documents, and biometric verification. All banks and financial institutions need to comply with KYC regulations. The KYC consists of 3 parts:

- Customer Identification – verifying a customer’s documents and looking for any information inconsistencies

- Customer Due Diligence

- Enhanced Due Diligence

Payoneer is also using a lot of sanction lists to screen your payee information:

- The Office of Foreign Asset Control (OFAC)

- PEP Sanction checks

- Her Majesty Treasury (HMT)

- RES 1988

- The Common Foreign and Security Policy (CFSP) of the EU

So, it looks pretty bulletproof. They also claim many layers of in-house and third-party security:

- Adaptive Authentication

- MaxMind

- AU10TIX

- InRule

- IDChecker

- IBM content analytics

So, how about taxes

Before choosing such a service, it is only natural to look at their fees. Sometimes, they make all the difference in your decision-making. It is understandable.

Nevertheless, costs shouldn’t be your only worry. There are also questions about functionality and usability that you should ask yourself. As for taxes, that’s another story as well. Payoneer allows you to pay your VAT directly from your Payoneer balance. Unfortunately, this function is not available for all countries, but it works for some.

What is more, when you create an account, you will be required to complete a few tax forms. Depending on your business, you will have to fill in a W-9, W-8BEN, or W-8ECI. If you need it, Payoneer will help you with tax data reports and your payees’ tax information.

Cool bonus feature – Payoneer capital advance

If you needed a nudge to believe Payoneer is extra-cool, then this is it. Are you a marketplace seller on Walmart or Amazon? Well, you’re in luck.

Payoneer could help you with a 35% advance on your funds, up to $500,000. The fee for this service is 2%. This working capital could be what will get your business skyrocketing. Payoneer will analyze your past sales performance. Based on that, it can predict future sales and offer you an advance. That could be a life savior.

And the Payoneer fees?

Well, opening an account is free. Sending and receiving payments between different Payoneer account holders is also free of charge. Transactions between marketplaces where Payoneer is integrated as also free. Other than these, there are some fees. So, shall we?

- 3% for credit card payments and %1 for eCheck payments to a person who doesn’t have a Payoneer account

- 2% to transfer your funds to your local bank account in another currency

- $1,5 to transfer your funds to your local bank account in the same currency

- Exchanging currencies in your Payoneer balance will incur a 0,5% charge

Now, these are not so bad. Overall, Payoneer is a solid payment solution. It might lack a few payment features, such as POS. Nevertheless, if you have a small to medium business or are a freelancer, Payoneer is a safe and easy method for getting paid. So, give it a try.

We hope this article has been very useful for you, and that you have also found out the answer to the question – “Positive pay to reduce which fraud ?”