Golden cross stock alerts are like a watchdog of your finances and can let you make the right choices at right time. The Golden cross stock market, which we are investigating today, is triggered when the instrument’s Moving Average lines cross over each other.

The size of the windows, as well as the MA calculation techniques, may be customized. You have two alternatives, just like with our MA break alert: Simple Moving Average (SMA) and Exponential Moving Average (EMA) (EMA).

It entails plotting the instrument’s 200-day moving average versus its 50-day moving average. It also looks for the times when they intersect.

When the 50-day moving average crosses over the 200-day moving average, it indicates that the uptrend is continuing and that it is a good opportunity to go long (buy).

The downtrend in golden cross stock alerts

A downtrend is indicated when the trend reverses and the 50-day MA crosses below the 200-day MA. As a result, it is time to either close your long position or go short (sell). This deceptively straightforward rule is arguably the most well-known technical indicator.

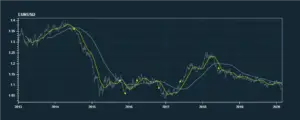

There is no such thing as a free lunch, as proven by testing the Golden Cross on EURUSD Daily data for the last 5 years.

It did, however, catch the big fall in 2014-2015. It also sent out a flood of negative signals, ultimately wiping out any profits.

One downside of this method is that the SMA is sluggish to respond to trend changes – it lags far behind. One option is to use a different method to calculate the moving average, such as the exponential moving average.

Because it gives more weight to the most recent values, the EMA reacts faster. This is especially noticeable when contrasted with the sluggish MA.

Golden cross-stock alerts and analytic techniques

The golden cross stock alerts are a technical indicator that displays when the faster-moving average of security crosses over the slower-moving average.

It is popular among traders and investors. The major golden cross that everyone utilizes is when the 50 MA crosses over the 200 MA.

A golden cross can be utilized in a number of situations.

Day traders work with shorter time horizons (5m, 10m, 15m, and so on). Swing traders, on the other hand, employ larger time frames (6h, 12h, daily, etc.).

When employed over longer time periods, the golden cross might indicate a significant shift toward higher prices. In actuality, the golden cross may be seen as a bullish trend indicator.

Definitions and distinctions between SMA, EMA, and VWMA

Some traders feel that the sort of MA you choose will influence your golden cross trading outcomes. However, we will demonstrate that success in trading the golden cross method does not result from using different MAs.

As a consequence, we first explained what these MAs are and how they differ, and then we compared the quality of the golden cross trading signal provided by each.

SMA golden cross stock alert

SMA stands for the simple moving average, and its formula is fairly simple to calculate.

If the past four candles’ closing prices are 25.5, 26, 27.5, and 28, your average is (25.5+26+27.5+28)/4=26.75.

If you repeat this calculation for more candles, you will have a line in your chart indicating the 4 SMA.

The golden cross SMA occurs when the 50 SMA crosses over the 200 SMA.

EMA golden cross stock alerts

EMA is for the exponential moving average, and we haven’t included its calculation here to avoid any complexities. The EMA, on the other hand, focuses a larger weight on current data, which is the main difference between it and the SMA.

Golden cross EMA happens when 50 EMA crosses above 200 EMA.

VWMA the golden cross stock alerts

It stands for the volume-weighted moving average, and we haven’t included its formula here to keep things simple. It differs from the other two MAs in that it places greater emphasis on candle trading volume.

As a result, a golden cross VWMA occurs when 50 VWMA crosses over 200 VWMA.

Golden cross stock alerts in the cryptocurrency market (bitcoin case study)

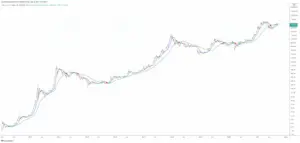

In the example given, we examined the Bitcoin daily chart to examine several of Mas’s golden crosses.

Bitcoin was in a bear market in 2015, and after the price fell to a low and fluctuated for a while, a new upswing gradually developed.

We’ve highlighted two golden crosses in the image below, and we’ll look at them separately.

The very first golden cross

The VWMA golden cross appeared first, followed by the SMA golden cross. The EMA golden cross, on the other hand, did not occur at all.

It was difficult to open a long trade with these golden cross indications. Because the major resistance zone was above us, the price was easily rejected, thus ending the climb.

So, the logical decision was to wait and see whether the price could break through the resistance region. Unfortunately, the price varied for a few days before falling within the primary support area.

We may open a long position near the bottom of the support area and close it whenever a death cross appears.

Second golden cross stock

In this case, all three golden crosses occurred in the following order: VWMA, SMA, and EMA.

Once the price has retraced into the resistance zone for the first time, you can enter a long trade.

You may terminate your trade if you noticed the long wicks of those candlesticks to the upward, which plainly indicated price rejection.

Once the price has retreated into the primary resistance zone (which has now been turned into a support zone) for the second time, you may enter a long position.

If you retained your long position, you might have a profit of nearly 2400 percent two years later!

Golden cross stock breakout

Ken Calhoun’s Golden Cross Breakouts method is a moving average-based technical indicator. It is designed for swing trading and makes use of two near-price moving averages before adding simulated orders based on their crossings.

It is designed for swing trading and makes use of two near-price moving averages before adding simulated orders based on their crossings. This technique’s name relates to the well-known “golden cross” breakout pattern.

When a security’s shorter moving average crosses over its long-term moving average, this occurs.

When the closing price’s 50-period simple moving average crosses over the 200-period one, the technique adds a simulated purchase order by default.

A simulated sell order is added when the price goes below the 50-period moving average. Instead of an exit, might be used a trailing stop, such as the TrailingStopLX.

It’s worth noting that you may personalize this technique by changing the moving average types and lengths in the input parameters.

Benefits of breakouts:

According to Wikipedia, breakouts are wonderful when markets are strong, but they are a nightmare when markets are trending sideways or downward. Every breakthrough must be pursued since no one knows when a major gain will begin or when a correction will end.

As a result, trading breakout needs a strong nerve as well as the ability to tolerate whipsaw losses.

When there has been a run of whipsaw losses, it is time for a bold move. The trader must then have the guts to pull the trigger. Regardless of the fact that he or she has suffered a run of whipsaw defeats. Significant news events may also trigger price technical analysis.

These breakouts are more unexpected and rely on the impacts of the news on specific security; they should be avoided if the security is not fundamentally sound.

Trading breakouts in a nutshell

Trading breakouts is a difficult endeavor. It appears to be counterintuitive.

Because the aphorism “no price is too high to buy” and “no price is too low to sell” are not commonly recognized, following this strategy necessitates a great deal of faith.

Only after back-testing the breakout approach across numerous time frames for multiple markets and securities can it be used as a strategy.

Breakouts are a whole trading strategy in and of themselves, and if used correctly and with sufficient risk management, they can be a very profitable trading approach in the long run.

Time period breakouts

A certain time span is used to identify and classify these breakouts. The most prevalent are 52-week breakouts, followed by intra-day breakouts.

Breakouts at 52-week highs

These are generally the most well-known breakout Golden cross stocks since they are frequently covered by media networks ranging from financial news channels to newspapers, radio shows, and local news programs.

Stocks that reach new 52-week highs excite the interest of both potential buyers and short-sellers.

However, it is widely held that once a company achieves its 52-week high, it has been fully acknowledged and profit-taking is imminent.

Breakouts of Intraday highs

These stocks are available on television tickers, online newswire services, and intraday stock scanners. Traders, rather than investors, are more likely to notice these. These stocks should be watched attentively for trading opportunities, and will most likely have momentum, volume, and liquidity.

Cryptocurrency and golden cross!

In its limited existence, the leading cryptocurrency by market cap has seen eight Golden Crosses and seven Death Crosses.

Following the bottom of the cryptocurrency in 2015, another fake-out event happened in which the cryptocurrency Golden Crossed, then Death Crossed, then Golden Crossed again.

The most recent signal boosted the value of Bitcoin from about $500 to $20,000. The bear market in 2018 began with a Death Cross and concluded with a Golden Cross, which lifted the cryptocurrency above the bear market lows.

Consolidation produced additional ambiguous signals in late 2019 and early 2020. It started with a Death Cross in October 2019, then a Golden Cross changed into a Death Cross, only to revert to a Golden Cross and drive Bitcoin from $4,000 to $65,000, comparable to the 2017 bull run.

Following such a move, it’s easy to see why investors may be wary of another Golden Cross producing comparable outcomes.

Bitcoin and death cross

After the most recent local high of almost $65,000, Bitcoin formed another Death Cross, albeit this time there was no major drop. With the reappearance of the Golden Cross, the market is fearful of another fake-out, but also wary of missing out on potential gain.

Previously, Bitcoin was the underdog, clawing its way to the top in whatever manner it could against all odds. Today, things are considerably different, and more sophisticated investors – including institutions, companies, hedge funds, and others – are participating.

Following a traditional market all-in signal, such as the Golden Cross, maybe a better choice now that smart money is finally entering the bitcoin market.

Forex trendy can be your maestro!

Forex trendy is an excellent software program that attempts to provide forex traders with a quick approach to profit in the competitive Forex market. Guarantees traders huge profits in the industry by offering the best Forex Trendy Pairs to use in the market.

You’ve probably noticed how erratic the patterns can be if you’ve been trading Forex for a time. As a result, predicting how the trends will look at the end of the day or the next day is challenging.

You may use Forex Trendy to track how foreign currency pairings change, giving you an idea of the best times to trade.

The stock alerts provided by this Forex Trendy program will protect your trade like angels and can provide you with the greatest stock notifications. These notifications will help you get the most out of your trading experience and make it a success!

How forex trendy works

It makes no use of indicators, instead relying solely on price movement to determine the trend.

It swiftly examines 34 Forex pairings across all time periods, from the minute to the monthly. This equates to 34 x 9 = 306 charts. Every second, Forex Trendy examines all of the charts for you! This way, you can access the greatest trending pair and time range at any moment.

The software runs on our sophisticated computers, so you can view the results quickly online.

It is really easy to use.

Forex Trendy is a considerably more advanced program that can recognize basic chart patterns. It examines all charts across all time frames and evaluates every possible breakthrough.

- Charts displaying emerging patterns in real-time, as well as a history of finished patterns

- Audible and email notifications for newly finished patterns

- Forex Trendy employs a complex algorithm to determine which trend line or pattern appears to be more appealing. Many traders make this mistake!

- Forex Trendy includes chart pattern identification at no extra cost!

Why not get yours? For better and more successful trading!